Record Building Levels Fail to Ease Cost Pressure into 2026

Australia enters 2026 with construction activity near record highs, even as costs remain elevated and contractors become harder to secure.

Data from Rider Levett Bucknall’s Q4 Construction Market Update for Australia shows $298 billion of construction work was delivered in 2024–25, close to a record high.

Engineering projects—mainly energy infrastructure—led the growth, alongside a lift in apartment construction.

Approvals for new apartments and townhouses rose 27 per cent in the nine months to September 2025, signalling further momentum in the pipeline.

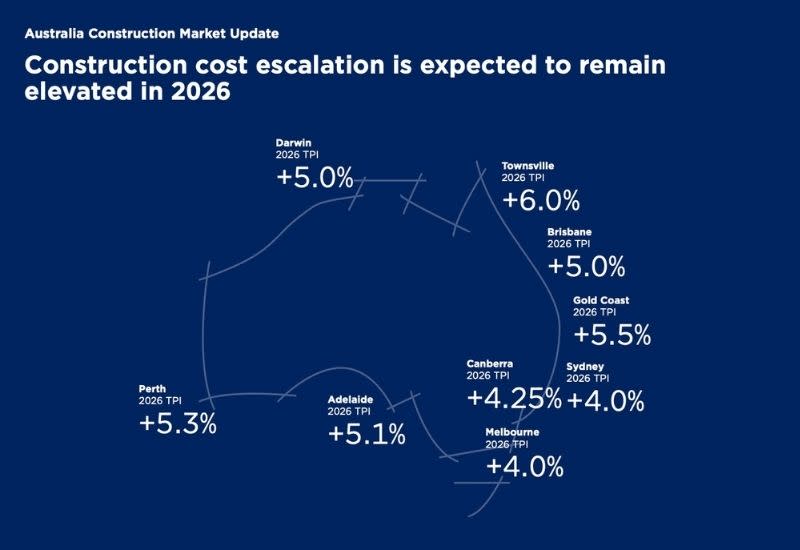

While cost growth eased in 2025, construction costs are forecast to rise again in 2026, climbing by around 4 to 6 per cent across major cities.

Labour shortages remain a key constraint, with ABS data showing house and apartment completion times have increased by around 40 per cent since pre-pandemic.

RLB director of Oceania research and development Oliver Nichols said the volume of work under way would continue to pressure pricing and delivery timelines.

“The Australian construction industry’s historically high activity levels are set to continue in 2026, underpinned by record work done and a robust pipeline driven by public infrastructure, defence and energy projects,” Nichols said.

State-by-state pressure points

Brisbane and the Gold Coast remain among the most constrained markets, with construction costs forecast to rise 5 per cent and 5.5 per cent respectively in 2026.

Olympic-related infrastructure and labour shortages continue to weigh on feasibility, although projects below about $80 million are attracting more competition.

RLB said a six-to-12-month window remained for well-prepared schemes before conditions tighten again from late 2026.

New South Wales has experienced a short-term easing in tender pricing as subcontractor competition lifts, with Sydney costs forecast to rise about 4 per cent in 2026.

RLB said the current pricing relief is temporary, with demand expected to tighten again from late 2026 as approved projects ramp up.

Further pressure is expected from 2027 as labour shifts north for Olympics-related work and key enterprise agreements reach expiry.

Victoria remains under pressure as insolvencies, labour shortages and past mega-project overruns keep baseline costs high.

Non-residential approvals in the state have lifted but private projects continue to stall on feasibility as revenues struggle to keep pace with construction costs.

Western Australia continues to operate near capacity, with Perth construction costs forecast to rise 5.3 per cent in 2026.

Defence, resources and infrastructure work dominate the pipeline, while regional projects face heightened cost volatility and limited Tier 1 competition.

South Australia and Canberra face sustained cost pressure as defence and public sector projects stretch Tier 1 capacity.

Adelaide is forecast to record 5.1 per cent cost growth in 2026, while Canberra sits at 4.25 per cent amid a strong forward pipeline.

In Darwin and Townsville, defence-driven demand and limited contractor competition continue to push costs higher, with Townsville forecast to record the highest escalation nationally at 6 per cent in 2026.

While construction cost escalation has eased from post-pandemic peaks, RLB data suggests pricing remains well above pre-pandemic norms, with labour shortages, insolvency pressures and public sector demand continuing to shape feasibility and project timing through 2026.