Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Loans rose for the first time in three months in February as competition between first home buyers and investors heats up.

The total value of new housing loans to investors rose 1.2 per cent in February 2024, according to data from the Australian Bureau of Statistics (ABS).

A total of $26.40 billion in new home and investment property loans were taken out in February, up by 1.5 per cent from January.

ABS head of finance statistics Mish Tan said the value of new investor loans in February was 21.5 per cent higher compared to a year ago.

“This made up over half of the growth in total new loan commitments over the past year,” she said.

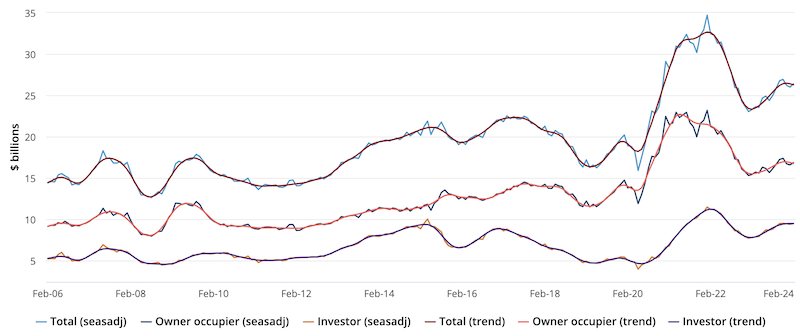

New commitments for housing excluding refinancing

The value of new owner-occupier loans was 9.1 per cent higher compared to a year ago, while the value of owner-occupier first home buyer loans was 20.7 per cent higher over the same period.

The total number of new owner-occupier loans rose 0.9 per cent in February. Meanwhile, the number of owner-occupier first home buyer loans rose 4.3 per cent and were 13.2 per cent higher compared to a year ago.

The value of new loan commitments for total fixed term personal finance fell 0.9 per cent to $2.4 billion. This was driven by a fall of 2.7 per cent in lending for the purchase of road vehicles.

The data indicated competition between first home buyers and investors was rising while upgraders were holding out for rate cuts, according to financial comparison site Canstar.

“Upgraders and downsizers were the least active in the market in February, rising by only 0.4 per cent during the month, with $11.95 billion in loans settled,” Canstar said.

“Meanwhile, first home buyers are showing a willingness to battle it out with investors, with activity for first-time buyers up 20.7 per cent compared to February, 2023.”